montana sales tax rate 2019

State and Local Sales Tax Rates as of January 1 2019 State State Tax Rate Rank Avg. In reviewing the history of a sales tax in other states the rate has continually been adjusted upward as infrastructure costs increase.

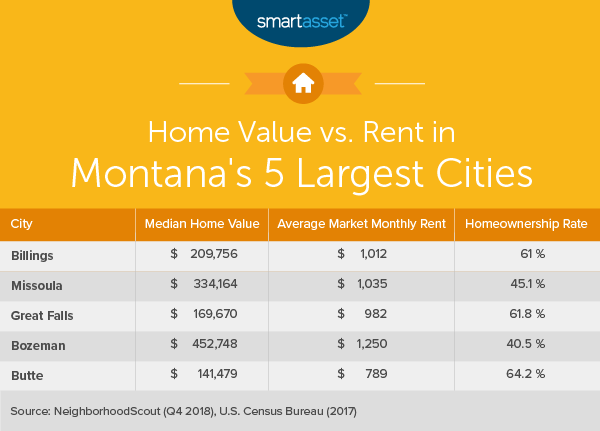

The Cost Of Living In Montana Smartasset

118 to 258 for 2019.

. The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. Your free and reliable 2019 Montana payroll and historical tax resource. The cities and counties in Montana also do not charge sales tax on general purchases so.

Tax rates last updated in August 2022. The revised tax year 2019 taxable percentage rate for class 12 property is estimated to be 320. Distillery Excise and License Tax.

1725 - 587 1138 tax. There is one additional tax district that applies to some areas geographically within Columbus. While there is no sales tax in Montana the state does collect excise taxes on alcoholic beverages.

Instead of the rates shown for the Missoula tax region above the following tax. Free Unlimited Searches Try Now. Imposition and rate of sales tax and use tax -- exceptions.

Montana charges no sales tax on purchases made in the state. Montana MT Sales Tax Rates by City. The minimum combined 2022 sales tax rate for Manhattan Montana is.

Oregons limit is 6500 Excludes Washingtons BO tax Page 3. 25000 x 69 0069 1725. What is the sales tax rate in Manhattan Montana.

Did South Dakota v. Montana is one of the five states in the USA that have no state sales tax. The Montana sales tax rate is currently.

By Justin Fontaine July 26 2019. Montana new employer rate. You can learn more about licensing and distribution from the Alcoholic Beverage Control Division.

Skip to main content. Some locations Montana such as Whitefish charge tax on lodging and prepared food. The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages.

There is 0 additional tax districts that applies to some areas geographically within Missoula. There are a total of 68 local tax jurisdictions across the state collecting an average local tax of 0002. Conducting a sales assessment ratio for class 4 commercial and industrial property.

Wayfair Inc affect Montana. Goods and services can be purchased sales-tax-free though sin taxes on alcohol and cigarettes do apply. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0.

For Alcoholic Beverage Taxes please select the tax type below. Per 15-6-145 MCA the Department of Revenue shall calculate the taxable percentage rate for class 12 property annually by. The Montana MT state sales tax rate is currently 0.

The Missoula sales tax rate is NA. In 2020 Montana ranked 26th in 2019. Ad Lookup MT Sales Tax Rates By Zip.

Montana tax rate is unchanged from last year however the income tax brackets increased due to the annual. The County sales tax rate is. This is the total of state county and city sales tax rates.

The Manhattan sales tax rate is. Tax rates last updated in January 2022. Your taxable income is 25000.

Your free and reliable 2019 Montana payroll and historical tax resource. In effect that lowers the top capital gains tax rate in Montana from 69 to 49. The Columbus sales tax rate is NA.

While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. 013 to 630 for 2019.

Click here for a. Sales tax region name. Montana State Disability Insurance SDI.

Montana Department of Revenue. Montana has no state sales tax and allows local governments to collect a local option sales tax of up to NA. The state sales tax rate in Montana is 0000.

Sales tax region name. Montana SUI Rates range from. Montana limits the amount of Federal taxes which can be deducted to 10000 for a mar- ried couple filingjointly and 5000 for individuals.

Tax Foundation Facts and Figures 2019 - Table 12 for 2019 2. There is no state sales tax in Montana. Montana is one of only five states without a general sales tax.

There are no local taxes beyond the state rate. The state sales tax rate in Montana is 0000. Local Tax Rate a Combined Rate Combined Rank Max Local Tax Rate Alabama 400 40 514 914 5 700 Alaska 000 46 143 143 46 750 Arizona 560 28 277 837 11 560 Arkansas 650 9 293 943 3 5125 California b 725 1 131 856 9 250.

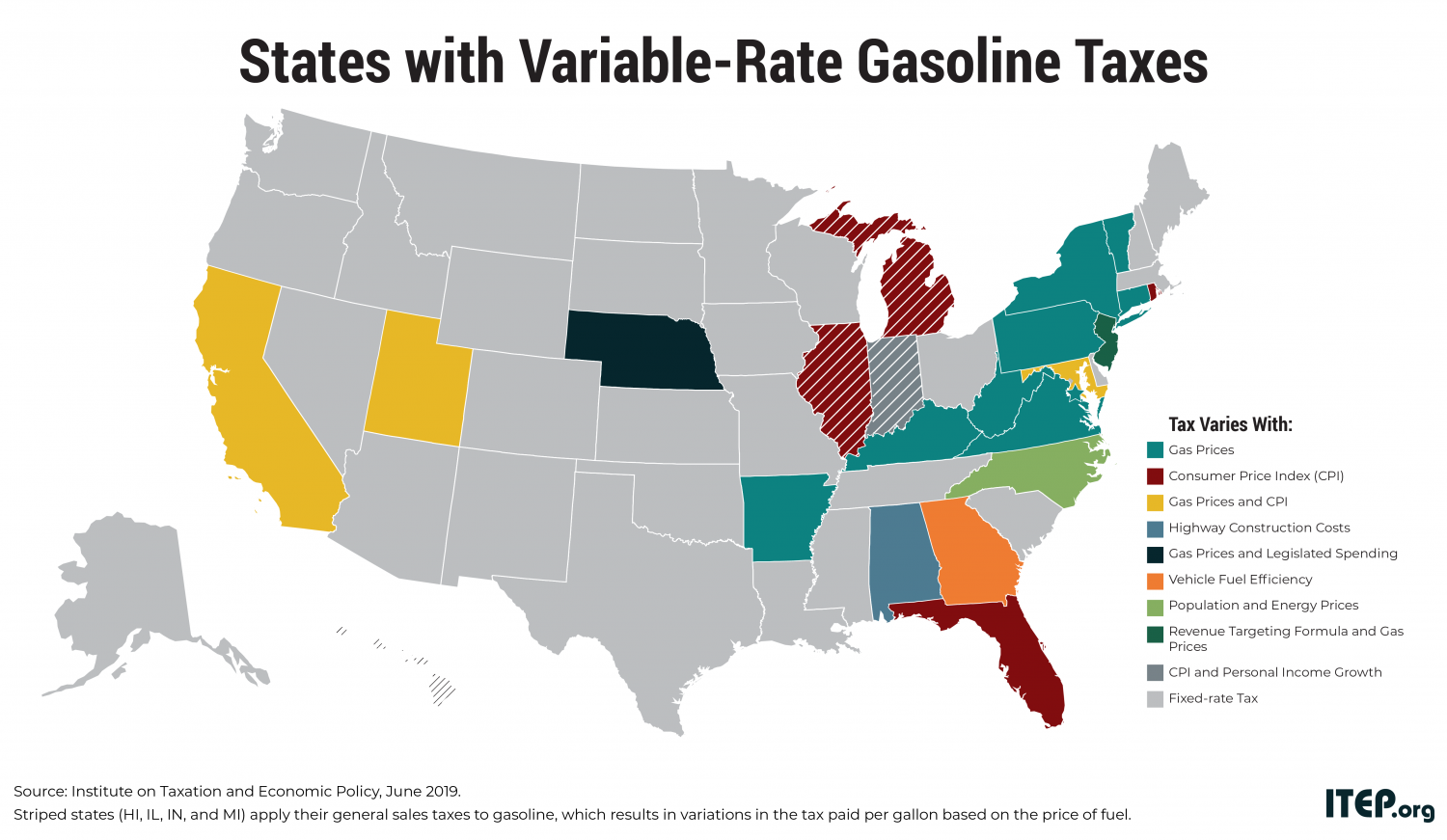

Most Americans Live In States With Variable Rate Gas Taxes Itep

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

States Without Sales Tax Article

States Without Sales Tax Article

How Do State And Local Sales Taxes Work Tax Policy Center

Taxes Fees Montana Department Of Revenue

Montana State Taxes Tax Types In Montana Income Property Corporate

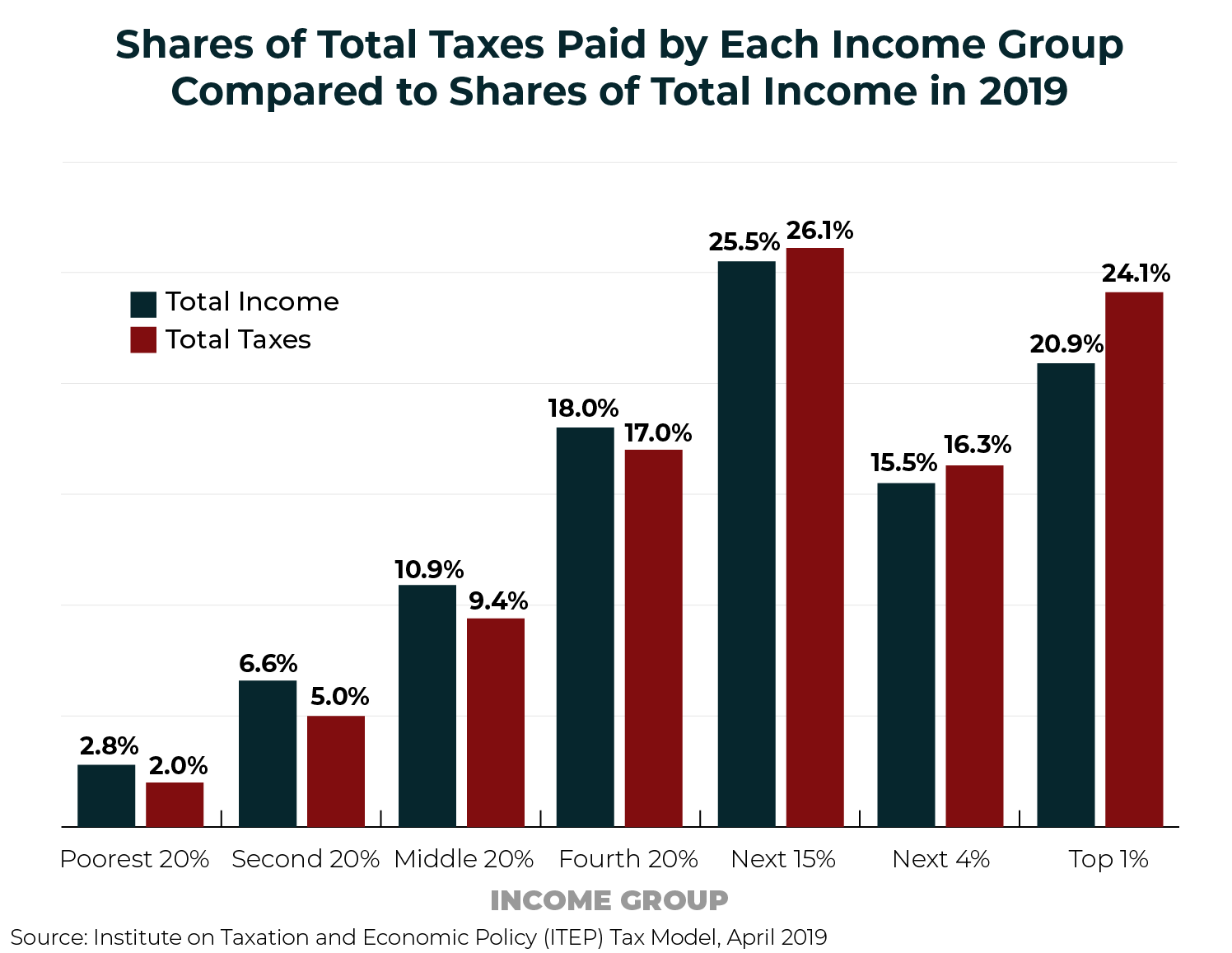

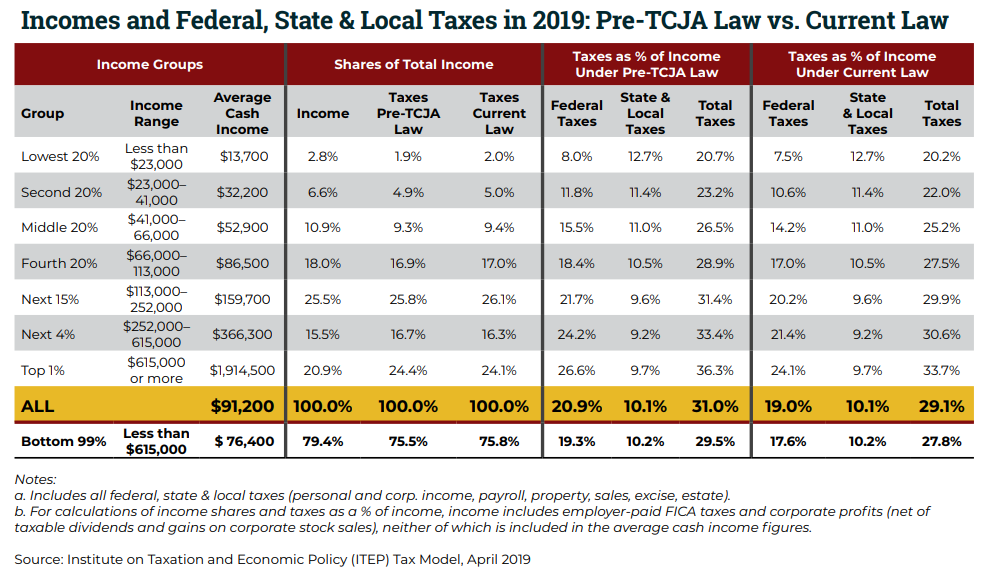

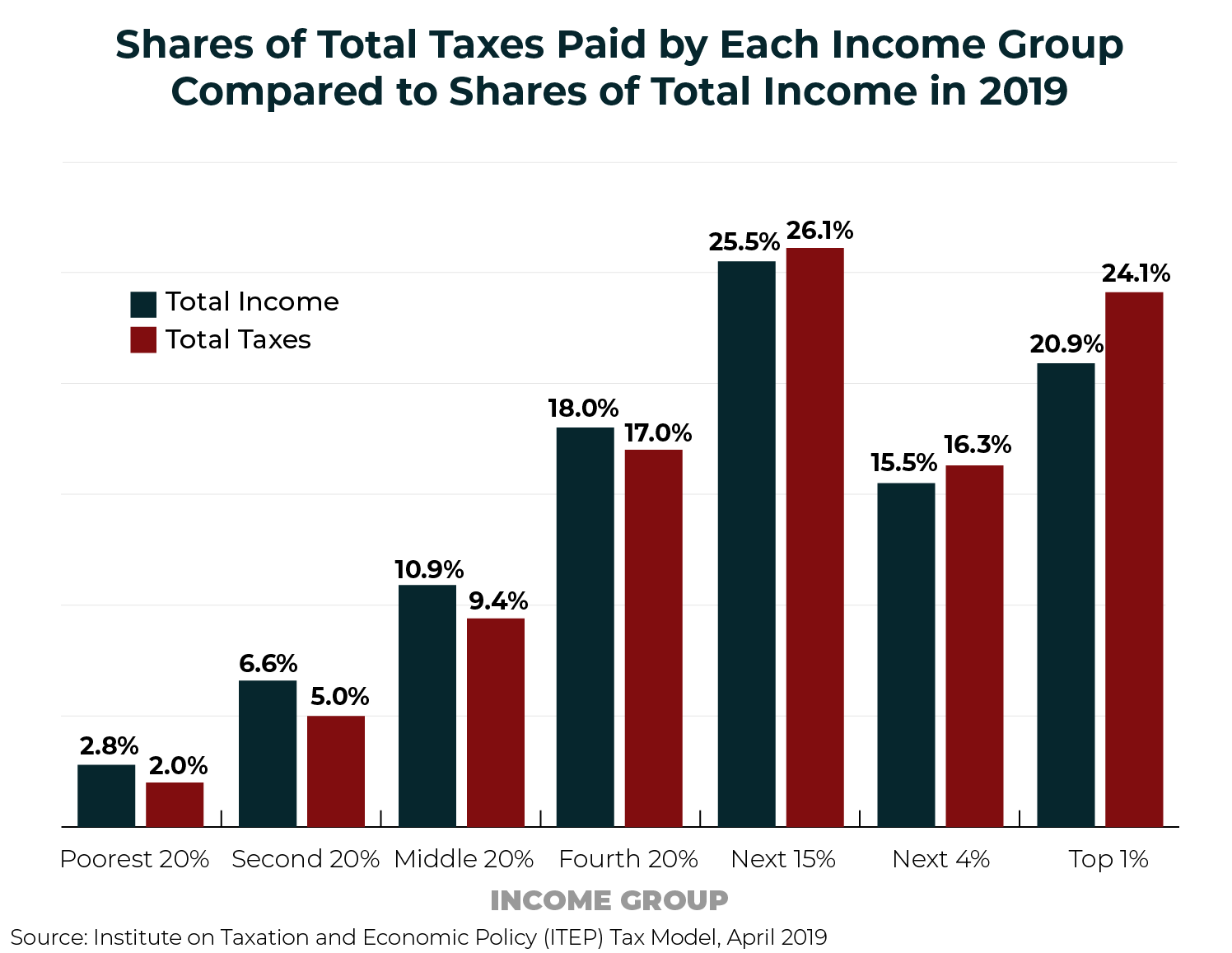

Who Pays Taxes In America In 2019 Itep

Montana State Taxes Tax Types In Montana Income Property Corporate

Who Pays Taxes In America In 2019 Itep

Montana State Taxes Tax Types In Montana Income Property Corporate

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Study Reveals Most Least Tax Friendly States How California Compares Ktla

How Do State And Local Sales Taxes Work Tax Policy Center

States Without Sales Tax Article

State Corporate Income Tax Rates And Brackets Tax Foundation